This page may contain affiliate links. If you make a purchase through these links, I may earn a commission at no additional cost to you. I only recommend products or services I believe in.

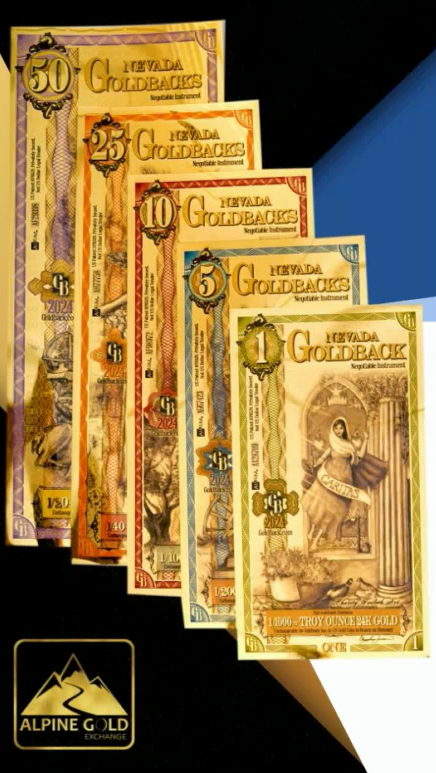

Goldbacks

Central banks worldwide hold large reserves of gold, often sitting dormant in secure vaults. This seemingly inactive asset, however, can be put to work through a fascinating financial practice known as goldback leasing.

This complex mechanism allows gold owners to generate income from their holdings without physically moving the precious metal.

Goldback leasing creates a ripple effect throughout the gold market, influencing price dynamics, mining operations, and even global economic policies. It’s what happens when paper promises can outweigh physical metal, and the line between asset utilization and market manipulation becomes incredibly thin.

In this comprehensive exploration, we’ll uncover the intricacies of goldback leasing, its impact on the global gold market, and the controversies surrounding this practice.

The Fundamentals of Goldback Leasing

What is Goldback Leasing?

Goldback leasing is a financial arrangement where a gold owner (the lessor) agrees to lend a specific amount of gold to a borrower (the lessee) for a predetermined period. The lessee pays a fee, typically expressed as an annualized percentage of the gold’s value, known as the lease rate.

The unique aspect of goldback leasing is that the physical gold often stays in the lessor’s possession. Instead, the transaction is recorded as a book entry, with the lessee gaining the right to use the gold’s value without taking physical possession of the metal itself.

Key Players in the Goldback Leasing Market

- Central Banks: As major holders of gold reserves, central banks are the primary lessors in the goldback leasing market.

They use this practice to generate income from their otherwise idle gold holdings.

- Gold Mining Companies: These entities often lease gold to hedge against price fluctuations and manage their financial risks.

- Jewelry Manufacturers: By leasing gold, jewelry makers can meet production needs without tying up significant capital in inventory.

- Traders and Speculators: Financial institutions and individual traders use leased gold for various market activities, including short-selling and arbitrage.

The Mechanics of Goldback Leasing

- Lease Agreement: The lessor and lessee enter into a contract specifying the amount of gold to be leased, the lease duration, and the lease rate.

- Book Entry: The transaction is recorded as a book entry, with the gold remaining in the lessor’s vault.

- Lease Rate Payment: The lessee pays the agreed-upon lease rate to the lessor, typically on a regular basis throughout the lease term.

- Settlement: At the end of the lease term, the lessee must return an equivalent amount of gold to the lessor, either through physical delivery or by purchasing gold on the open market.

The Golden Web: Complex Financial Instruments

Goldback leasing transactions often involve a sophisticated array of financial instruments, creating a complex web of interconnected deals and risks.

Forwards

Forward contracts allow parties to agree on a future price for gold delivery. In the context of goldback leasing, forwards can be used to lock in prices and manage risk.

Swaps

Gold swaps involve exchanging gold for cash or other assets for a specified period. These instruments can be used in conjunction with leasing to create more complex financial structures.

Options

Options give the holder the right, but not the obligation, to buy or sell gold at a predetermined price. Lessees might use options to hedge against adverse price movements in the gold market.

The Midas Touch: Impact on the Gold Market

Goldback leasing has far-reaching implications for the entire gold market, affecting everything from supply and demand dynamics to price discovery mechanisms.

Supply and Demand Dynamics

When gold is leased, it effectively increases the available supply in the market. This extra “paper gold” can put downward pressure on gold prices, at least in the short term.

The increased supply, even if only on paper, can alter market perceptions and influence trading decisions.

Price Discovery and Volatility

The interplay between physical gold and the “paper gold” created through leasing can lead to increased market volatility. The price discovery process becomes more complex as market participants must consider both the physical and paper markets when making decisions.

The Gold Carry Trade

Goldback leasing is closely linked to the gold carry trade, where investors borrow gold at low lease rates and invest the proceeds in higher-yielding assets. This practice can create arbitrage opportunities and further affect gold price dynamics.

Rehypothecation: The Invisible Gold Rush

One of the most controversial aspects of goldback leasing is the practice of rehypothecation. This occurs when the same ounce of gold is “lent” many times, creating a scenario where paper claims on gold can far exceed the amount of physical gold available.

The Multiplier Effect

Through rehypothecation, a single ounce of gold can generate many lease agreements. This multiplier effect can significantly increase the apparent supply of gold in the market, potentially distorting prices and creating systemic risks.

Systemic Risk Concerns

The practice of rehypothecation raises serious concerns about systemic risk in the financial system. If there were ever a “run on the gold bank,” with many parties demanding physical delivery simultaneously, the system could face a crisis of confidence that could ripple through the entire financial market.

Transparency Issues and Market Manipulation Allegations

The goldback leasing market is largely over-the-counter and lacks standardized reporting. This opacity makes it difficult to assess the full extent of leasing activities and their impact on the broader gold market.

The Murky Waters of Reporting

The lack of transparent reporting in the goldback leasing market creates an environment ripe for speculation and mistrust. Market participants and observers often struggle to get an accurate picture of the true state of gold supply and demand.

Market Manipulation Allegations

Some critics argue that central banks and large financial institutions use goldback leasing to manipulate gold prices, keeping them artificially low to maintain confidence in fiat currencies. While these claims are unproven, the lack of transparency in the market allows such theories to continue.

Navigating the Golden Maze: Understanding Goldback Leasing

For those looking to understand or join in the goldback leasing market, several key factors need attention:

1. Lease Rates

The gold lease rate, often quoted as an annualized percentage, is a crucial indicator of market conditions. Low lease rates can show an abundance of gold available for leasing, while higher rates might suggest tighter supply.

2. Market Anomalies

Unusual spreads between spot gold prices and futures contracts could show significant leasing activity. These anomalies can provide insights into market dynamics and potential trading opportunities.

3. Central Bank Activities

As major players in the goldback leasing market, central banks’ actions can have significant impacts. Monitoring their gold-related activities and policy statements can provide valuable insights.

4. Derivatives Understanding

Familiarity with gold forwards, swaps, and options is essential, as these instruments are integral to many leasing transactions. Understanding how these derivatives work and interact can help in navigating the complex world of goldback leasing.

5. Broader Economic Context

Gold leasing activities can be influenced by factors such as interest rates, currency fluctuations, and geopolitical events. Keeping an eye on the broader economic landscape is crucial for understanding the goldback leasing market.

The Golden Future: Evolving Trends in Goldback Leasing

As the financial world continues to advance, the practice of goldback leasing is also evolving. Several trends are shaping the future of this market:

The Rise of Gold-Backed ETFs

The increasing popularity of gold-backed exchange-traded funds (ETFs) is creating new dynamics in the gold market. These funds often use goldback leasing as part of their operations, adding a new dimension to the practice and potentially increasing market liquidity.

Blockchain and Gold Leasing

Blockchain technology has the potential to bring greater transparency to the goldback leasing market. Some companies are exploring ways to tokenize gold and create more effective leasing mechanisms using blockchain, which could address some of the transparency concerns plaguing the current system.

Regulatory Scrutiny

As concerns about systemic risk and market manipulation continue, regulators are paying closer attention to goldback leasing practices. This increased scrutiny could lead to new reporting requirements and oversight mechanisms in the future, potentially altering the landscape of the goldback leasing market.

Case Studies: Goldback Leasing in Action

To better understand the real-world implications of goldback leasing, let’s examine a few historical cases and their impacts on the gold market.

The 1999 Gold Crisis

In 1999, a sudden spike in gold lease rates caused significant market turmoil. The crisis was triggered by a combination of factors, including concerns about central bank selling, millennium-related demand for physical gold, and speculative short-covering.

This event highlighted the interconnectedness of the goldback leasing market with broader financial systems and demonstrated how quickly market conditions can change.

The 2008 Financial Crisis

During the 2008 financial crisis, the goldback leasing market experienced significant stress. As financial institutions scrambled for liquidity, many turned to their gold holdings, either selling outright or engaging in leasing activities.

This period demonstrated how goldback leasing can serve as a source of liquidity during times of financial stress, and highlighted the potential risks associated with rehypothecation and the complex web of financial instruments tied to gold.

The 2013 Gold Price Crash

In April 2013, gold prices experienced a dramatic crash, falling by more than $200 per ounce in just two days. While many factors contributed to this event, some analysts pointed to the role of goldback leasing and related derivatives in exacerbating the price decline.

This case underscores the potential for goldback leasing and associated financial instruments to amplify market movements, both up and down.

The Role of Goldback Leasing in Central Bank Policy

Central banks use goldback leasing as a means of generating income from their gold reserves and as a tool for implementing monetary policy and managing market perceptions.

Signaling and Market Intervention

By adjusting their goldback leasing activities, central banks can send signals to the market about their intentions and outlook. For example, a central bank might increase its leasing activities to suggest confidence in the stability of fiat currencies, potentially putting downward pressure on gold prices.

Reserve Management

Goldback leasing allows central banks to maintain their gold reserves on their balance sheets while still deriving some economic benefit from the asset. This can be particularly important for countries looking to maintain the appearance of strong gold holdings while still utilizing the value of their reserves.

International Cooperation

The goldback leasing market can serve as a channel for international cooperation among central banks. By coordinating their leasing activities, central banks can potentially influence global gold markets and support broader economic goals.

Environmental and Ethical Considerations

While goldback leasing primarily involves paper transactions, it’s important to consider its indirect environmental and ethical implications.

Impact on Mining Activities

The availability of leased gold can influence mining companies’ decisions about production levels and exploration activities. If leasing increases the apparent supply of gold, it could potentially reduce incentives for new mining projects, indirectly affecting environmental concerns related to gold extraction.

Transparency and Accountability

The opacity of the goldback leasing market raises ethical questions about market fairness and the potential for manipulation. As the financial world increasingly emphasizes transparency and accountability, the practices surrounding goldback leasing may come under greater scrutiny.

Socioeconomic Implications

The complex financial instruments associated with goldback leasing can have far-reaching socioeconomic impacts. For example, if leasing activities contribute to gold price volatility, this could affect the livelihoods of artisanal miners or the economic stability of gold-producing nations.

Frequently Asked Questions

What is the purpose of goldback leasing?

Goldback leasing allows gold owners, particularly central banks, to generate income from their gold reserves without selling the physical metal. It also provides a mechanism for other market participants to access gold for various financial purposes.

How does goldback leasing affect gold prices?

Goldback leasing can potentially put downward pressure on gold prices by increasing the apparent supply of gold in the market. However, the relationship is complex and influenced by many factors.

Is goldback leasing regulated?

Goldback leasing is largely unregulated and operates in over-the-counter markets. However, increasing concerns about transparency and systemic risk may lead to greater regulatory scrutiny in the future.

Can individual investors join in goldback leasing?

While goldback leasing is primarily a tool for large institutions, individual investors can gain exposure to related market dynamics through gold-backed ETFs or by trading gold derivatives.

What risks are associated with goldback leasing?

Key risks include counterparty risk, potential market manipulation, and systemic risks related to rehypothecation. The opacity of the market also creates challenges in assessing and managing these risks.

How does goldback leasing differ from physical gold ownership?

Goldback leasing involves paper transactions and does not typically involve the movement of physical gold. It’s a financial instrument as opposed to a form of direct ownership.

What is the relationship between goldback leasing and gold futures markets?

Goldback leasing can influence gold futures markets by affecting supply and demand dynamics and price discovery processes. The two markets are closely interconnected.

How do central banks use goldback leasing in their monetary policy?

Central banks can use goldback leasing as a tool for managing market perceptions, implementing monetary policy, and generating income from their gold reserves.

Key Takeaways

- Goldback leasing allows gold owners to generate income from idle reserves without physically moving the metal.

- The practice significantly impacts gold market dynamics, influencing supply, demand, and price discovery mechanisms.

- Rehypothecation in goldback leasing creates potential systemic risks by allowing many claims on the same physical gold.

- Lack of transparency in the goldback leasing market raises concerns about potential market manipulation and accurate assessment of gold supply.

- Central banks play a crucial role in the goldback leasing market, using it as a tool for reserve management and monetary policy implementation.