This page may contain affiliate links. If you make a purchase through these links, I may earn a commission at no additional cost to you. I only recommend products or services I believe in.

Gold continues to shine as a cornerstone of wealth preservation, but today’s investors have more options than ever.

Enter Goldback Leasing, a revolutionary way to own gold and earn returns, brought to life by companies like Alpine Gold.

Unlike traditional Gold Investment, where trusted names like Birch Gold shine with their expertise in physical gold—think classic coins, bars, or ETFs—Goldback Leasing transforms gold into an active asset that works for you. Curious about how it stacks up? Start Earning with Goldback Leasing Today.

In this article, we’ll dive into Goldback Leasing’s technology, features, and benefits, stacking it up against traditional gold investment—including Birch Gold’s stellar offerings—to show why both are golden in 2025!

As a long-time skeptic of choice financial instruments, I never imagined I’d find myself captivated by a new form of currency, especially one backed by gold.

Yet, that’s precisely what happened when I attended a local economic forum where an enthusiastic entrepreneur showcased Goldbacks.

Holding one of these gold-infused bills in my hand, feeling its weight, and admiring its intricate design, I realized this wasn’t just another passing trend.

It was a tangible piece of financial innovation bridging the gap between traditional gold investments and everyday currency.

Traditional gold investment offers a different vibe: you order a gold coin or bar, and it arrives with that satisfying heft. It’s tangible, classic, and evokes a sense of history. Both approaches celebrate gold’s allure, but Goldback Leasing adds a layer of interactivity that feels tailor-made for 2025. Want to see it in action? [Learn More About Goldbacks]

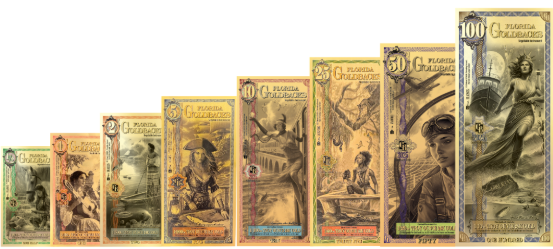

The Golden Revolution: Understanding Goldbacks

Goldbacks represent a novel approach to combining the stability of gold with the practicality of paper currency.

Each Goldback contains a specific amount of 24-karat gold, typically ranging from 1/1000th to 1/50th of a troy ounce, depending on the denomination.

This design allows for a level of divisibility and portability that’s often lacking in traditional gold investments.

The theoretical foundation of Goldbacks stems from the concept of sound money – currency with intrinsic value that resists inflation and government manipulation. By embedding actual gold into a spendable form, Goldbacks aim to provide a stable store of value that can also function as a medium of exchange.

Technology Details: The Innovation Behind Goldback Leasing

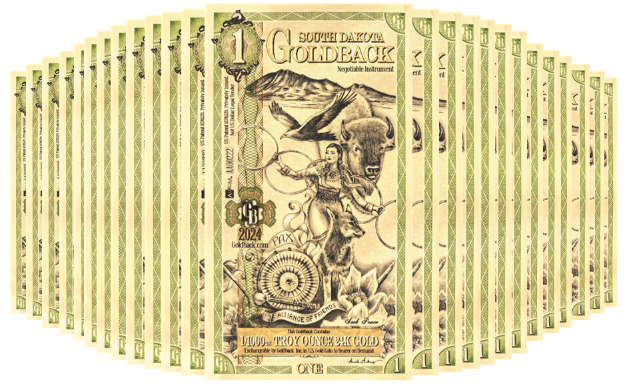

Goldback Leasing thrives on cutting-edge tech that redefines gold ownership. Goldbacks are crafted with a patented process: 24-karat gold is atomized and encased in durable polymer via vacuum deposition, creating a spendable currency with denominations from 1 to 50 Goldbacks.

The leasing program, powered by Alpine Gold, uses these notes as “rotating inventory” for production—your gold stays insured and active without vaulting fees. It’s a seamless fusion of physical and digital innovation.

On the other hand, a traditional gold investment keeps it simple: coins and bars are minted or cast from pure gold, requiring no fancy tech. Gold ETFs take a paper-based approach, trading on exchanges without physical handling.

While effective, these methods lack Goldback Leasing’s dynamic edge. This technology makes leasing a forward-thinking choice for investors who value gold’s heritage with a modern twist.

Key Features: What Makes Goldback Leasing Stand Out?

Goldback Leasing brings a host of features that elevate it above traditional gold investment:

- Gold Returns: Earn 2% to 3.5% annually, paid monthly in Goldbacks. A 100,000 Goldback lease at 3.5% nets you 292 Goldbacks monthly—gold that grows your stash!

- Flexibility: Open-ended leases with a 60-day exit notice—far more fluid than static gold bars.

- Zero Fees: Vaulting and insurance are included, unlike the costs of storing physical gold.

- Full Ownership: Your Goldbacks remain yours, leased to fuel production without liens.

- Low Entry: Start with just 10 Goldbacks, opening the door for all investors.

Traditional gold investment counters with:

- Simplicity: Buy a coin or bar—no platforms or contracts needed.

- Liquidity: Gold sells easily worldwide, a universal asset.

- Proven Value: Physical gold’s centuries-long track record speaks for itself.

Goldback Leasing merges gold’s reliability with income potential, offering a fresh take for 2025 portfolios. Secure Your Gold Portfolio Now.

Benefits: Why Goldback Leasing Shines in 2025

Goldback Leasing delivers benefits that make it a top pick this year:

- Passive Income: Unlike idle gold bars, leasing pays you monthly in Goldbacks—gold that grows with rising prices. In 2025’s bullish gold market, that’s a win!

- Inflation Shield: Returns in gold dodge fiat currency erosion, a critical edge as inflation persists.

- Wealth Growth: Monthly payouts compound your holdings—3,500 Goldbacks yearly from a 100,000-GB lease adds up fast!

- Hassle-Free: Managed online via Alpine Gold, it skips the storage and shipping headaches of physical gold.

- Real Impact: Your lease powers Goldback production, supporting a currency embraced by over 2,000 U.S. businesses.

Traditional gold investment excels too:

- Rock-Solid Stability: A tangible hedge against economic chaos—perfect for long-term peace of mind.

- Global Reach: Accepted everywhere, it’s a borderless store of value.

Goldback Leasing takes gold’s strengths and supercharges them with returns and ease—ideal for today’s investor. Ready to make gold work harder?

Usage Instructions: How to Get Started with Goldback Leasing

Starting with Goldback Leasing is effortless:

- Join: Sign up for a free UPMA account at Alpine Gold in minutes.

- Fund: Add cash, crypto, or metals to buy Goldbacks.

- Lease: Allocate your Goldbacks to a lease—10 GB for 2% or 75,000+ GB for 3.5%.

- Earn: Receive monthly Goldback payments—vault them, cash out, or take delivery.

- Exit: Need flexibility? Terminate with 60 days’ notice and reclaim your Goldbacks.

Traditional gold investment is straightforward:

- Purchase: Buy coins, bars, or ETFs from a dealer or exchange at Birch Gold Group.

- Store: Secure it in a safe, vault, or let an ETF handle it.

- Sell: Cash in when prices climb—no returns, just appreciation.

Leasing offers an active, rewarding path that traditional gold can’t replicate—a perfect fit for hands-on investors. See How Easy It Is.

Conclusion: Why Goldback Leasing Wins

Goldback Leasing vs. Gold Investment is not about picking a “winner”—it’s about matching your goals. Traditional gold investment is the steady foundation: simple, liquid, and trusted worldwide. But Goldback Leasing? It’s the gold standard reimagined: innovative, income-generating, and built for 2025’s fast-moving economy.

With gold-based returns, no fees, and online ease, it’s a golden ticket to grow your wealth while staying anchored in precious metals. Whether you’re diversifying or chasing passive income, Goldback Leasing is a must-explore option.

Investment Strategy

Consider how Goldbacks fit into your broader investment portfolio, balancing them with traditional gold investments and other assets. Evaluate your risk tolerance and financial goals to decide the suitable allocation for Goldbacks within your overall investment strategy.

Consider consulting with a financial advisor who is knowledgeable about choice currencies and precious metals investments.

Emergency Fund

Use Goldbacks as part of your emergency fund, providing a hedge against currency devaluation during crises. Allocate a portion of your emergency savings to Goldbacks, balancing liquidity needs with potential long-term value preservation.

This approach can offer peace of mind during economic uncertainties while maintaining quick access to funds.

Travel Money

In regions where Goldbacks are accepted, they can serve as a unique and potentially stable form of travel money. Research destinations where Goldbacks are recognized and consider using them as a complement to traditional travel currencies.

This strategy can provide a hedge against exchange rate fluctuations and offer a conversation starter with locals interested in choice currencies.

Gift Giving

Goldbacks make interesting and potentially appreciating gifts, introducing others to the concept of gold-backed currency.

Goldbacks make an exceptional choice for gift-giving, blending practicality with a touch of luxury.

Imagine presenting a loved one with a beautifully crafted Goldback note—each infused with 24-karat gold and available in denominations from 1 to 50—perfect for birthdays, holidays, or special milestones in 2025.

Unlike traditional gifts, Goldbacks offer lasting value: recipients can use them as a spendable currency at over 2,000 U.S. businesses, save them as a gold investment. It’s a thoughtful, versatile present that says, “I care about your future,” all wrapped in the timeless appeal of gold

Frequently Asked Questions

What are Goldbacks?

Goldbacks are a form of currency that contains small amounts of real gold. They are designed to be used for everyday transactions while also serving as a store of value.

How much gold is in a Goldback?

The amount of gold in a Goldback varies by denomination, typically ranging from 1/1000th to 1/50th of a troy ounce of 24-karat gold.

Where are Goldbacks accepted?

Goldbacks are now accepted in a number of U.S. states, including, Florida, Utah, Nevada, Wyoming, New Hampshire, and South Dakota. These are areas where there is strong support for choice currencies and sound money principles.

Can Goldbacks be used as an investment?

Yes, Goldbacks can be used as an investment. Their value is tied to the price of gold, potentially offering protection against inflation and currency devaluation.

How do Goldbacks compare to traditional gold investments?

Goldbacks offer greater divisibility and ease of use compared to traditional gold investments like coins or bars.

Are Goldbacks legal tender?

Goldbacks are not legal tender in the United States. They are a voluntary private currency, accepted by individuals and businesses who choose to use them.

How do I store Goldbacks safely?

Goldbacks should be stored in a cool, dry place, protected from direct sunlight and extreme temperatures. For larger quantities, consider using a fireproof safe or safety deposit box.

Can I exchange Goldbacks for other currencies?

Yes, Goldbacks can be exchanged for other currencies through authorized dealers or individuals willing to trade. The exchange rate will typically be based on the current gold price.

Do Goldbacks have serial numbers?

Yes, each Goldback has a unique serial number for identification and security purposes.

How do I verify the authenticity of a Goldback?

Goldbacks have several security features, including holographic elements and specific gold patterns. You can also check the serial number with the issuing company for verification.