This page may contain affiliate links. If you make a purchase through these links, I may earn a commission at no additional cost to you. I only recommend products or services I believe in.

States like Florida, South Dakota, Nevada, Wyoming, and Utah each offer their own unique Goldback designs. Soon Arizona and Oklahoma will offer Goldbacks, too. The question for buyers becomes: where can you find the cheapest place to buy goldbacks?

Goldbacks have emerged as an intriguing option for those looking to invest in physical currency backed by precious metals.

These small-denomination, gold-infused notes are designed to be both a collectible and a functional form of money, accepted by a growing number of merchants in states where they’re issued.

In this article, we’ll dive into the factors that influence Goldback prices, compare offerings across these states, and spotlight Alpine Gold as a key vendor. Whether you’re a collector, investor, or simply curious about this alternative currency, read on to discover how to get the best deal.

What Are Goldbacks?

Before we explore pricing, let’s clarify what Goldbacks are. Introduced in 2019 by Goldback Inc., these notes are made with a thin layer of 24-karat gold embedded between protective polymer sheets.

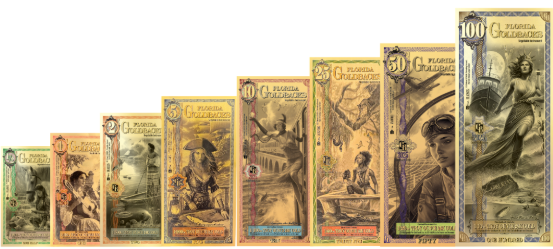

Available in denominations of 1, 5, 10, 25, and 50, each Goldback contains a precise amount of gold—1/1000th of an ounce for the smallest note, scaling up from there. Unlike traditional bullion, Goldbacks are intended for everyday use, blending the tangible value of gold with the convenience of paper currency.

Each participating state issues its own series, featuring designs that reflect local culture and history. Florida Goldbacks might showcase coastal motifs, while Wyoming Goldbacks celebrate rugged frontier themes.

This state-specific approach adds a collectible appeal, but it also raises questions about availability and cost. Prices typically exceed the spot value of gold due to production costs, premiums, and market demand, so finding the cheapest source requires some research.

Factors Influencing Goldback Prices

To identify the cheapest place to buy Goldbacks, it’s essential to understand what drives their cost:

- Gold Spot Price: The baseline value of the gold content fluctuates daily. As of March 5, 2025, gold prices remain a key variable—check live rates for the most current data.

- Premiums: Vendors charge a markup for manufacturing, distribution, and profit. This premium varies widely.

- Shipping Costs: Online purchases often include shipping fees, which can tip the scales on total cost.

- Local Availability: Buying directly from merchants or vendors in issuing states might cut out middleman fees.

- Vendor Reputation: Established sellers like Alpine Gold may offer competitive pricing due to volume, while smaller dealers could charge more—or less, depending on inventory.

With these factors in mind, let’s compare Goldbacks from Florida, South Dakota, Nevada, Wyoming, and Utah, and see how Alpine Gold stacks up.

Florida Goldbacks: Sunshine State Savings?

Florida joined the Goldback movement recently, with notes reflecting its vibrant coastal heritage. Given its large population and tourism-driven economy, you might expect robust local demand—and thus higher prices.

However, Florida’s Goldbacks are still relatively new, which could mean lower premiums as vendors compete to establish a market.

Online retailers often list Florida Goldbacks alongside other states, but local dealers in cities like Miami or Orlando might offer deals to attract early adopters. Shipping from Florida-based sellers could also be cheaper for East Coast buyers, potentially making it a cost-effective option.

When you lease your goldbacks from Alpine Gold, you retain ownership of the leased metals, which remain 100% insured against loss or theft.

Also, during the lease period, the cost to vault and insure your metals are waived for all metals leased.

Click here for more details on Florida Goldbacks.

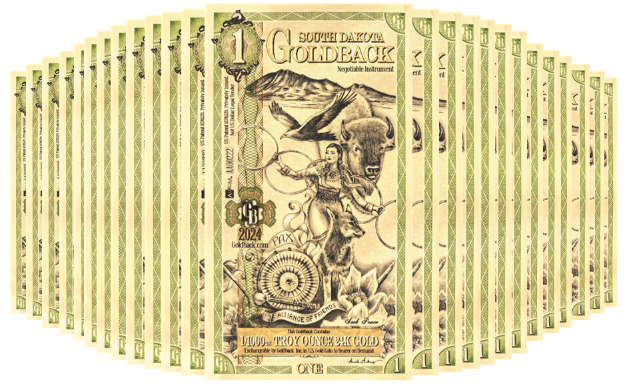

South Dakota Goldbacks: A Midwest Bargain?

South Dakota’s Goldbacks appeal to those drawn to its low-tax, business-friendly reputation. With fewer residents than Florida, demand might be lower, keeping premiums in check.

However, South Dakota’s rural nature means fewer local vendors, so buyers often turn to online sources.

This could increase shipping costs unless you’re near a hub like Sioux Falls. South Dakota Goldbacks are less hyped than Utah’s, which might translate to better deals if you’re willing to shop around.

When you lease your goldbacks from Alpine Gold, you retain ownership of the leased metals, which remain 100% insured against loss or theft.

Also, during the lease period, the cost to vault and insure your metals are waived for all metals leased.

Click here for more details on South Dakota Goldbacks.

Nevada Goldbacks: Gambling on a Deal

Nevada, with its gold mining history and libertarian leanings, is a natural fit for Goldbacks. The state’s notes often feature desert-inspired designs, appealing to collectors.

Nevada’s proximity to Utah—where Goldbacks originated—could mean lower distribution costs, but Las Vegas’s tourist market might inflate prices due to demand from visitors.

Online vendors shipping from Nevada often bundle Goldbacks with other precious metals, so look for bulk discounts to save.

When you lease your goldbacks from Alpine Gold, you retain ownership of the leased metals, which remain 100% insured against loss or theft.

Also, during the lease period, the cost to vault and insure your metals are waived for all metals leased.

Click here for more details on Nevada Boldbacks.

Wyoming Goldbacks: Frontier Value

Wyoming’s Goldbacks reflect its cowboy ethos, and its sparse population suggests a niche market. This could work in your favor—fewer buyers might mean lower premiums, especially from local sellers.

Wyoming’s libertarian streak also aligns with Goldback adoption, so you might find motivated vendors offering competitive rates. However, shipping from Wyoming to distant states could offset savings unless you buy in volume.

When you lease your goldbacks from Alpine Gold, you retain ownership of the leased metals, which remain 100% insured against loss or theft.

Also, during the lease period, the cost to vault and insure your metals are waived for all metals leased.

Click here for more details on Wyoming Goldbacks.

Utah Goldbacks: The Original Standard

Utah, where Goldbacks were first launched, remains the epicenter of the movement. Its notes, featuring pioneer themes, are the most established and widely recognized.

High demand from collectors and local users can drive up premiums, but Utah’s dense network of Goldback-friendly businesses and vendors—like Alpine Gold—offers opportunities for savings. Buying directly from Utah-based sources might avoid extra shipping fees for nearby states, making it a strong contender for the cheapest option.

When you lease your goldbacks from Alpine Gold, you retain ownership of the leased metals, which remain 100% insured against loss or theft.

Also, during the lease period, the cost to vault and insure your metals are waived for all metals leased.

Click here for more details on Utah Goldbacks.

Spotlight on Alpine Gold

One standout vendor across these states is Alpine Gold, a Utah-based precious metals dealer closely tied to the Goldback ecosystem. Alpine Gold serves as an official exchange and retailer, offering Goldbacks from multiple states, including Florida, South Dakota, Nevada, Wyoming, and Utah.

Their direct connection to Goldback Inc. often translates to competitive pricing, as they bypass some intermediary markups. Alpine Gold also provides a leasing program, where buyers can earn 2% to 3.5% annual returns by lending their Goldbacks—a unique perk for investors.

What sets Alpine Gold apart for cost-conscious buyers? They frequently offer bulk pricing, reducing the per-unit cost for larger purchases. Their website often lists Goldbacks near spot price plus a modest premium, and they ship nationwide.

For those in Utah or nearby states, in-person pickup could eliminate shipping fees entirely. Alpine Gold’s reputation for transparency and customer service also adds value, ensuring you’re not overpaying for hidden costs.

Comparing Costs Across States and Vendors

So, where’s the cheapest place to buy? Let’s break it down:

- Florida Goldbacks: Potentially lower premiums due to newness, but shipping costs vary.

- South Dakota Goldbacks: Modest demand might mean better deals, though rural shipping could add up.

- Nevada Goldbacks: Competitive if bought locally or in bulk, but tourist demand may hike prices.

- Wyoming Goldbacks: Niche market could yield bargains, especially from local sellers.

- Utah Goldbacks: Higher demand but offset by vendors like Alpine Gold offering volume discounts.

Online marketplaces like eBay or smaller dealers might occasionally undercut Alpine Gold, but watch for inflated shipping or authenticity risks. For a reliable benchmark, check JM Bullion, a high-authority precious metals site (DA 63). JM Bullion stocks Goldbacks from multiple states and often lists them at competitive rates, though premiums may exceed Alpine Gold’s for smaller orders.

Tips for Finding the Cheapest Goldbacks

- Compare Premiums: Look beyond the gold content—focus on the total cost per note.

- Buy in Bulk: Vendors like Alpine Gold and JM Bullion often slash prices for larger quantities.

- Check Local Markets: In issuing states, small businesses or coin shops might offer deals.

- Monitor Shipping: Free or flat-rate shipping can make a big difference.

- Time Your Purchase: Gold prices dip periodically—pair that with vendor sales for maximum savings.

Final Thoughts

Finding the cheapest place to buy Goldbacks depends on your location, purchase size, and preferred state series. Florida Goldbacks might appeal to East Coast buyers, while Utah’s established market—bolstered by Alpine Gold—offers reliability and volume discounts. South Dakota, Nevada, and Wyoming each bring unique advantages, from lower demand to regional proximity. For the best deals, cross-reference Alpine Gold’s offerings with authority sites like JM Bullion, and don’t shy away from local vendors if you’re in an issuing state.

Goldbacks blend investment potential with practical use, making them a compelling choice in uncertain times. By shopping smart, you can secure these golden notes at the lowest possible cost—whether you’re stacking Florida’s coastal designs or Wyoming’s frontier flair. Start your search today, and let the savings shine.

Resources: