This page may contain affiliate links. If you make a purchase through these links, I may earn a commission at no additional cost to you. I only recommend products or services I believe in.

In recent years, a unique form of voluntary currency has emerged in the United States: Goldbacks. These thin, gold-infused notes, combine the intrinsic value of 24-karat gold with the practicality of paper money.

Designed for local use and backed by real gold, Goldbacks have gained traction in specific states, known as “Goldback states,” where they are either issued or increasingly accepted. This article explores the states with Goldback series, their history, legal status, and the growing appeal of this alternative currency, optimized for search engines with key insights and an authoritative resource.

What Are Goldbacks?

Goldbacks are flexible notes made by embedding .999 fine gold between layers of durable polyester, produced using advanced vacuum deposition technology by Valaurum, a private mint. Each note contains a precise amount of gold, ranging from 1/1000th of an ounce (1 Goldback) to 1/20th of an ounce (50 Goldback). Available in denominations of 1, 5, 10, 25, and 50, Goldbacks are designed for small transactions, making gold a viable medium of exchange.

Unlike fiat currency, which relies on government backing, Goldbacks derive their value from their gold content, offering a hedge against inflation. They are not federally recognized legal tender but operate as voluntary currencies in states where businesses and individuals choose to accept them.

The Goldback States: Where Are They Issued?

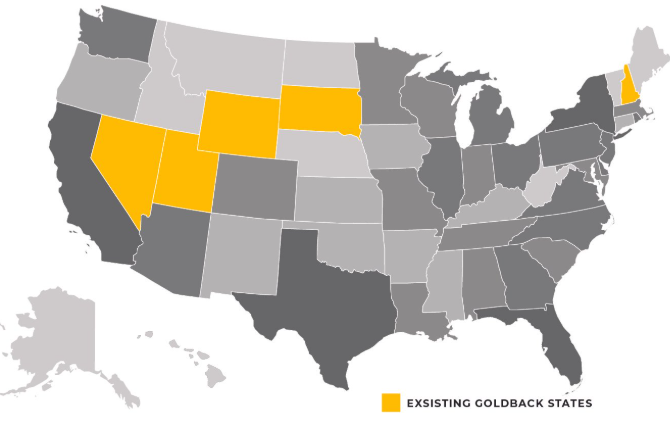

As of early 2025, six states have their own Goldback series, each with unique designs reflecting local culture and heritage. These “Goldback states” are:

- Utah: The pioneer of Goldbacks, Utah launched its series in 2019 following the state’s 2011 Legal Tender Act, which recognized gold and silver as legal tender. Utah Goldbacks feature virtues like Prudence and Liberty, with over 600 businesses accepting them by 2025.

- Nevada: Introduced in 2020, Nevada Goldbacks highlight the state’s mining history, with designs like Caritas (Charity) and Justitia (Justice). Their adoption aligns with Nevada’s gold-rich economy.

- New Hampshire: Launched in 2021, New Hampshire Goldbacks resonate with the libertarian Free State Project, featuring Fortitude and Liberty. They’ve seen widespread use in local trade.

- Wyoming: Debuting in 2022, Wyoming Goldbacks celebrate the state’s pioneer and Native American heritage, with figures like Reverentia (Reverence) and Audentia (Boldness). Nearly 40 businesses accept them.

- South Dakota: Introduced in 2023, South Dakota Goldbacks showcase historical landmarks and values, gaining traction among local merchants.

- Florida: The newest addition, announced in October 2024 and released on January 15, 2025, Florida Goldbacks introduce new denominations (1/2, 2, and 100) and reflect the state’s diverse natural and cultural heritage.

These states represent the current lineup of Goldback series, with more potentially on the horizon as interest grows.

Why These States?

Goldback states share common traits that make them ideal for this currency experiment:

- Legislative Support: States like Utah, Wyoming, and Arizona (a potential future candidate) have laws favoring precious metals as legal tender or exempting them from sales tax.

- Cultural Alignment: Many Goldback states have communities interested in sound money principles, economic independence, or libertarian ideals, such as New Hampshire’s Free State Project.

- Proximity: Several Goldback states (Utah, Nevada, Wyoming) are geographically close, facilitating regional adoption.

Posts on X highlight growing interest, with users speculating about future states like Idaho, Indiana, or Texas based on legislative trends and precious metal enthusiasm.

Legal Status in Goldback States

Goldbacks are not legal tender under federal law but operate as voluntary currencies. In Utah, the 2011 Legal Tender Act and 2022 House Bill 268 bolster their use by recognizing gold as a medium of exchange and exempting Goldback sales from state taxes. Other Goldback states lack explicit Goldback-specific laws but benefit from broader precious metal-friendly policies. For example:

- Nevada: No specific Goldback law, but its gold-producing status supports adoption.

- Wyoming: Recognizes gold and silver as legal tender, aligning with Goldback use.

Businesses in these states voluntarily accept Goldbacks, treating them as barter items or gold products with intrinsic value.

The Value and Appeal of Goldbacks

Goldbacks’ value is tied to gold’s spot price, fluctuating with market conditions. In early 2025, with gold at approximately $2,000 per ounce, a 1 Goldback (1/1000 oz) has a base value of $2, though retail prices often range from $4-$5 due to production and collectibility premiums.

Their appeal lies in:

- Inflation Resistance: Unlike fiat currency, Goldbacks retain value through gold.

- Portability and Divisibility: Easier to use than gold coins or bars for small purchases.

- Collectibility: Artistic designs make them popular among numismatists.

In Goldback states, they’re used for everything from buying candy to paying landscapers, fostering local economies independent of federal monetary systems.

The Future of Goldback States

With over 8 million Goldbacks produced and 450,000 users by 2025 (per Goldback, Inc.), the movement is expanding. Goldback, Inc. has hinted at plans to introduce series in additional states, potentially every U.S. state by 2030, if production and demand align. States like Idaho (delayed from 2024), Arizona (with recent gold-friendly legislation), and Indiana (considering legal tender bills) are frequently mentioned as candidates.

This growth reflects a broader “sound money” movement, challenging fiat currency dominance amid economic uncertainty. As more states adopt Goldbacks, they could reshape local commerce and investment landscapes.

Conclusion

Goldback states—Utah, Nevada, New Hampshire, Wyoming, South Dakota, and Florida—represent a pioneering effort to reintroduce gold-backed currency into everyday life. Blending practicality, artistry, and economic resilience, Goldbacks offer a unique alternative for residents, collectors, and investors.

As the list of Goldback states grows, so does the conversation about sound money in America’s future.