This page may contain affiliate links. If you make a purchase through these links, I may earn a commission at no additional cost to you. I only recommend products or services I believe in.

Investing Options During Trade Wars

Trade wars—those tense periods of tariffs, sanctions, and economic standoffs—can send ripples through global markets. From the U.S.-China tariff battles to policy shifts, these conflicts create uncertainty that shakes stocks, bonds, and currencies.

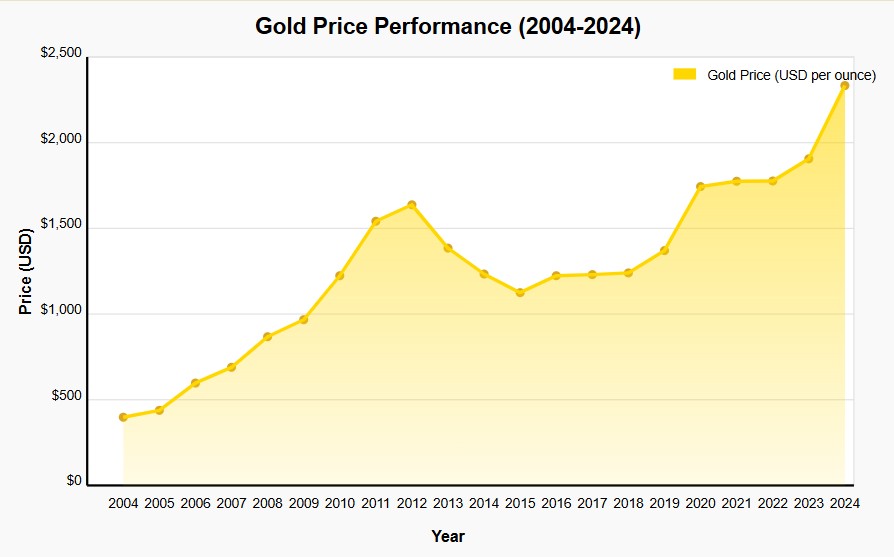

But one asset often shines brighter in these stormy times: gold. Known as a safe-haven investment, gold has a long history of holding value when economies wobble. If you’re looking to protect your wealth during trade wars, investing in gold could be your anchor—and Augusta Precious Metals is a trusted partner to guide you through.

Gold at $3,500? Experts Reveal Why It Could Be Coming Sooner Than You Think.

Why Gold Thrives During Trade Wars

When countries slap tariffs on each other, markets react. Trade wars disrupt supply chains, inflate costs, and fuel fears of economic slowdowns. Investors, seeking stability, often turn to gold. Here’s why:

- Hedge Against Uncertainty: Gold’s value doesn’t rely on any single economy or currency, making it a buffer when trade disputes spark volatility.

- Inflation Protection: Tariffs can drive up prices, eroding purchasing power. Gold historically keeps pace with or outstrips inflation.

- Global Demand: As central banks and investors worldwide buy gold during crises, its price often climbs, offering potential growth.

Take the 2018-2019 U.S.-China trade war: while stock markets jittered, gold prices rose nearly 20% as investors sought safety. With tariff talks making headlines, gold’s appeal remains strong.

Why Choose Augusta Precious Metals?

Augusta Precious Metals stands out as a leader in the gold IRA industry, helping investors diversify their retirement savings with physical gold and silver. Founded in 2012, Augusta has earned a stellar reputation for transparency, education, and customer support.

Unlike some firms that push sales, Augusta focuses on empowering you with knowledge to make informed decisions.

Whether you’re new to gold investing or a seasoned pro, their services are tailored to navigate the complexities of trade war-driven markets.

Key Benefits of Augusta Precious Metals

Augusta offers a range of features that make it an excellent choice for investing in gold during trade wars:

- Free Educational Resources: Augusta provides one-on-one web conferences led by their Harvard-trained economist, Devlyn Steele. These sessions cover the economy, gold’s role as a hedge, and how trade wars impact markets. You’ll walk away with clear insights, no pressure attached.

- Streamlined IRA Process: Augusta handles up to 95% of the paperwork for setting up or transferring a gold IRA, making it easy to add gold to your retirement portfolio. They work with trusted custodians like Equity Trust to ensure compliance and security.

- Competitive Pricing: Augusta waives up to 10 years of annual fees for qualifying gold and silver IRAs, reducing your costs. Their transparent pricing includes free shipping and insurance on all orders.

- Extensive Product Selection: Choose from IRS-approved gold and silver coins and bars, including American Gold Eagles and Canadian Maple Leafs. Augusta’s experts help you pick assets suited for trade war volatility.

- Lifetime Support: Once you’re a client, Augusta assigns a dedicated customer success agent to guide you for the life of your account—perfect for staying informed as trade policies evolve.

With an A+ rating from the Better Business Bureau, a AAA rating from the Business Consumer Alliance, and awards like “Best Overall Gold IRA Company” from Money Magazine (2022-2024), Augusta’s track record speaks for itself.

How Augusta Helps You Navigate Trade Wars

Trade wars can feel like a maze of economic headlines and market swings. Augusta simplifies the process of investing in gold to protect your wealth:

- Step 1: Get Educated: Download Augusta’s free gold IRA kit or join their web conference to understand how gold fits into your strategy.

- Step 2: Open an IRA: Augusta’s team guides you through setting up a self-directed IRA, handling most of the paperwork.

- Step 3: Choose Your Metals: Select from their high-quality gold and silver products, with expert advice tailored to trade war risks.

- Step 4: Secure Storage: Your metals are stored in IRS-approved depositories, with segregated options for added peace of mind.

- Step 5: Stay Supported: Augusta’s lifetime support keeps you updated on market shifts, helping you adjust as trade wars unfold.

This hands-on approach ensures you’re not just buying gold—you’re building a strategy to weather economic storms.

Why Augusta Stands Out During Trade Wars

Not all gold IRA companies are created equal. Augusta’s focus on education, transparency, and long-term support makes it a top pick for trade war investing:

- Trust and Reliability: Thousands of five-star reviews and endorsements from figures like Joe Montana highlight Augusta’s commitment to clients.

- Market Expertise: Their team, including on-staff economists, provides insights into how tariffs and trade policies affect gold prices.

- Flexibility: Beyond IRAs, Augusta offers direct purchases of gold and silver for those wanting physical assets outside retirement accounts.

While trade wars rattle markets, Augusta’s steady guidance helps you invest with confidence.

Is Now the Time to Invest in Gold?

Trade wars aren’t just news—they’re signals of deeper economic shifts. With tariffs driving uncertainty, gold’s role as a safe haven is more relevant than ever. But investing isn’t just about timing; it’s about partnering with the right company. Augusta Precious Metals offers the tools, expertise, and support to make gold a cornerstone of your portfolio.

Ready to take the next step? Augusta’s no-pressure approach lets you explore gold investing at your own pace, with resources to answer every question. Don’t let trade wars catch you off guard—secure your financial future today.